Written by Remy Haynes, Photographs by Angel E. Vera

SIR DANIEL WINN'S TIMELESS SERIES ENTERS THE NFT LANDSCAPE

In the words of Charles Darwin, "It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is most adaptable to change." I am reminded of this when I sat down with the founder of Winn Slavin Fine Art, Sir Daniel Winn, to discuss the possibility of investing in NFT's. An internationally recognized blue-chip artist, fine-art curator, awarded entrepreneur, and philanthropist, Daneil is always thinking about what is on the horizon and how he can grow as an artist. "NFT’s are the Wild Wild West right now." he explains. "no one knows where thev will lead but we've got to adapt, and this is an exciting time.’

NFT's, or Non-Fungible Tokens, began being discussed in association with Bitcoin and the gaming industry over five years ago but have hit the scene with a vengeance the last year. Now it’s all we can talk about. What they are and how they’re taken the art scene by storm was what Daniel and I were aiming to get to the bottom of in our discussion. I asked why he thought art community, so it seemed, was embracing this new idea more than others. “As artists, we’re always looking for new ways to get our art out to a broader audience, to have it seen and appreciated on a larger scale.” With NFT’s Daniel’s fan base could grow from thousands to mills and Daniel sees that enormous potential in that growth as well as new agencies Daniel could potentially contract with to produce his own NFT artwork.

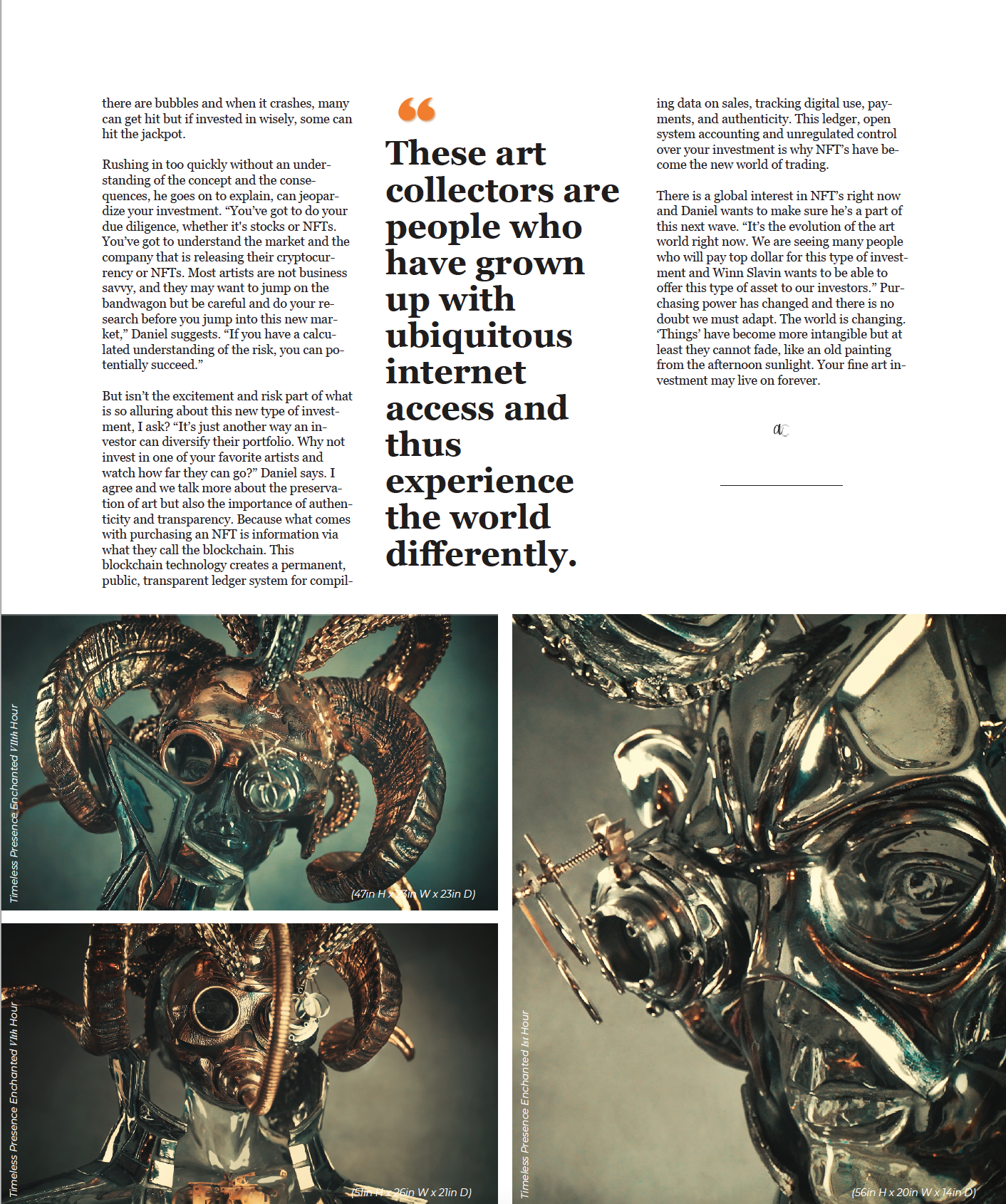

So, what are NFT’s and how will embracing this new platform help artists? “Imagine this,” he says and I’m all ears, “using CGI they make a 3D scan of one of my sculptures or paintings and the digitized version is available for sale but not just for sale, for investment. That is what NFT’s are, they are like investing in an artist to see how far he or she will rise.” Essentially by creating his own NFT, Daniel’s art will become a commodity that can be traded. It basically becomes another way art investors can invest in their favorite artists but in a more environmentally conscious way. No, you don’t have a sculpture or a piece of art hanging in your living room, but you do have a certificate of authenticity and ownership much like the deed to your home.

“This is a new, exciting platform for digital art investment and Winn Slavin wants to be a part of it,” Daniel explains. “It’s an exciting new concept for a new generation of art collectors – digital natives. These art collectors are people who have grown up with ubiquitous internet access and thus experience the world differently. They are as comfortable viewing the world on screen as in person.” This can’t be denied. We are in a tech boom and you either learn how to compete in this new world or you’re left behind quickly.

I ask him more about potential partnerships with NFT agencies. One of the primary aspects to consider is whether a company “focuses solely on NFT art and helping artists navigate this new platform,” Daniel says. He is excited about new partnerships and lies the idea of using technology to digitally immortalize art so it can be captured and archived for our future generations. He also tells me that he likes the fact that it’s a different form of investment and currency. Sure, it’s new and there are some risks but with any explosion of new technologies, whether it was an industrial revolution or the Golden Age of Renaissance, there can be some consequences and fallouts, particularly if they are high risk. Like the stock market, there are bubbles and when it crashes, many can get hit but if invested in wisely, some can hit the jackpot.

Rushing in to quickly without an understanding of the concept and the consequences, he goes on to explain, can jeopardize your investment. “You’ve got to do your due diligence, whether it’s stocks or NFT’s. You’ve got to understand the market and the company that is releasing their cryptocurrency or NFT’s. Most artists are not business savvy, and they may want to jump on the bandwagon but be careful and do your research before you jump into this new market,” Daniel suggest. “If you have a calculated understanding of the risk, you can potentially succeed.”

But isn’t the excitement and risk part of what is so alluring about this new type of investment, I ask? “It’s just another way an investor can diversify their portfolio. Why not invest in one of your favorite artists and watch how far they go?” Daniel says. I agree and we talk more about the preservation of art but also the importance of authenticity and transparency. Because what comes with purchasing an NFT is information via what they call the blockchain. This blockchain technology creates a permanent, public, transparent ledger system for compiling data on sales, tracking digital use, payments, and authenticity. This ledger, open system accounting and unregulated control over your investment is why NFT’s have become the new world of trading.

There is a global interest in NFT’s right now and Daniel wants to make sure he’s a part of this next wave. “it’s the evolution of the art world right now. We are seeing many people who will pay top dollar for this type of investment and Winn Slavin wants to be able to offer this type of asset to our investors.” Purchasing power has changed and there is no doubt we must adapt. The world is changing. ‘Things’ have become more intangible but at least they cannot fade, like an old painting from the afternoon sunlight. Your fine art investment may live on forever.